BATTERY POWER - THE NEXT BIG THING!

Home > Buy a Business > Wholesale > BATTERY POWER - THE NEXT BIG THING!

Key Features

- Genuine reason for sale - retirement

- High gross profit margin of 45%

- Exclusive essential product supplier status

- 10,000 + customers – built over decades

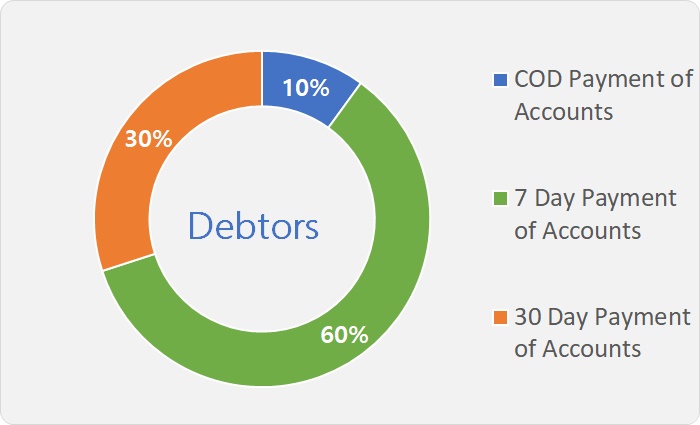

- Rapid payment of accounts – 70% pay in just 7-days

- No one client represents more than 2% of sales

- 20 + years established

BATTERY POWER - THE NEXT BIG THING! :: Essential + Expandable

.

GET READY - For The Profit Ride Of You're Life!

South-West...

...Power Storage Is Demand Driven Gold

Exclusive <$> Diversified

Powerhouse Product Range

EXCLUSIVE DISTRIBUTION RIGHTS

.

Essential + Sustainable + Expansion-Ready

CASH-FLOW + WHOLESALE

.

You're Just in Time For The Next Growth Phase!!

.

Unstoppable Growth Sectors…

It'll be hard to find a business that matches the low-risk features of this investment opportunity, seamlessly combining wholesale operations with a consistently growing base of cash-paying customers. Its entire focus is on essential, eco-friendly, and cost-saving products that centrally placed it at the heart of the internationally acclaimed southwest coastal strip with rapid population growth within its massive exclusive contracted territory.

It'll be hard to find a business that matches the low-risk features of this investment opportunity, seamlessly combining wholesale operations with a consistently growing base of cash-paying customers. Its entire focus is on essential, eco-friendly, and cost-saving products that centrally placed it at the heart of the internationally acclaimed southwest coastal strip with rapid population growth within its massive exclusive contracted territory.

Stop Press! - News Just to Hand...

WA’s BATTERY BOOM - Starts July 1st, 2025!

This industry sector is poised for significant growth through the implementation of substantial government battery rebates commencing 1 July 2025 - and that's just the beginning!. Federal Government media releases have also expressed their willingness to grow this vital consumer cost-saving market across Australia by also offering attractive rebates.

What this means for this business:

With an extensive customer database of over 11,000 previously satisfied customers, this new forthcoming customer rebate scheme presents an exceptional opportunity to leverage previous relationships and drive accelerated sales growth.

An Inviremental Necessity - Makes it hard to go wrong!

Western Australia is on the cusp of a major surge in battery adoption. Despite having more than 531,000 solar systems installed, residential battery uptake sits at just 10,000 units as of mid-2024....

MORE ABOUT THIS BUSINESS

The industry sector is poised for significant growth through the implementation of substantial government battery rebates commencing 1 July 2025. For established solar distributors with extensive existing customer databases, this presents an exceptional opportunity to leverage previous relationships and drive accelerated sales growth.

Australian Battery Market Overview

The Australian battery storage market has demonstrated a remarkable growth trajectory in recent years. In 2024, approximately 75,000 residential battery units were installed nationwide, representing a 63% increase from the 46,127 units installed in 2023. The national battery attachment rate (percentage of solar installations that include battery storage) reached 19% by mid-2024, approaching record levels established in late 2023. Total residential battery installation figures now exceed 185,798 units across Australia.

The Western Australian Government has announced a comprehensive solar battery rebate program scheduled to commence on 1 July 2025. This $387 million initiative will provide substantial financial incentives to accelerate residential battery adoption1312:

-

Enhanced rebates of up to $7,500 for Horizon Power customers11012

-

No-interest loans of up to $10,000 with 10-year repayment terms for qualifying households10

The program aims to deliver more than 200 megawatt-hours of storage to Western Australia's electricity grid, representing approximately 20,000 battery installations12. This target would effectively triple the current installed battery base in the state.

This Business is well-positioned to take advantage of the enormous potential that lies ahead. With its approximate 10,000 + customer database, the launch of the battery rebate program represents an extraordinary business opportunity for a new owner.

For this business's existing and previous satisfied customers:

-

They have already demonstrated a willingness to invest in renewable energy technology

-

They have established trust with this company through previous purchases

-

They currently own a solar system that could be optimised to further lower energy costs through battery integration

-

They are prime candidates for upselling to battery storage solutions

Applying even the current national battery attachment rate of 19% - source: 14 to this existing customer base could yield approximately 2,090 potential battery sales. However, with the substantial financial incentives offered by the WA rebate scheme about to commence on July 1st 2025, conversion rates will likely significantly...

Western Australia has experienced more modest battery adoption compared to leading states like South Australia and the Northern Territory, with approximately 10,000 residential batteries installed as of mid-2024. However, this represents significant growth potential given WA's exceptionally high solar penetration rate, with more than 531,000 solar installations across the State. This substantial imbalance between solar and battery adoption rates indicates vast untapped market potential.

Where Necessity Meets Sustainability!…

- Genuine Reason for Sale – Retirement

- Get Ready – The Next Growth Phase is about to start on June 30th, 2025 – “The Government Battery Rebate Scheme”

- Long Established with Proven Growth In Recessions

- High Gross Profit Margin of 45% – Fortified by Demand

- Exclusive Supplier Status – Reduces Risk

- 10,000 + Customers – Built Over Decades

- Rapid Payment of Accounts – 70% Pay in Just 7 Days

- Long Established Wholesale Customers

- Automatic Sales Growth – Demand Driven by Products and Population Growth

- No Employee Hassles – Low Number of Full-Time Staff

- High Asset Mix (Plant & Stock) of $457,000 Included in Price

- No One Client Represents More Than 2% Of Annual Sales

- Low Overheads

- No Stress – Live and Profit in The Pristine, Growing Southwest

- Systems And Procedures – Runs Like Clockwork.

- Five-Day Week Trading – Weekends Are Always Free

- No Industry Experience Required – Easy to Learn

- Products Are a Legacy Brand Name Australia-wide

- Triple Locked-In Sales Growth – Regional Population Growth, Essential Products, New Products

Future-Proofed Sales Expansion…

Away from the high-stress, congested life, it has been well documented that the South West region is poised for significant economic and population growth.

Currently, the region is home to around 374,388 people (2023 Estimated Residential Population). That number is projected to grow by 172,566 between 2026 and 2046.

WANT MORE PROOF!

1 :: A recent research report (November 2024) from the “Regional Australia Institute” reveals that an impressive 40% of city residents are considering relocating to regional areas, marking a significant increase from the 20% reported in May 2023.

This credible report also projects that Greater Bunbury’s population will reach 172,700 by 2056, while Busselton is expected to grow to 68,500. With this anticipated rise in regional population, the potential for increased profitability is extensive. Upon closer analysis, it becomes evident that the primary challenge for management is not identifying opportunities for expansion but rather selecting the most advantageous options from the many available.

2 :: Bunbury’s Emergence as Australia’s Fastest-Growing Regional Hub in 2025 – Bunbury has solidified its position as Australia’s fastest-growing regional city in 2025, driven by unprecedented population growth and infrastructure development.

The Regional Movers Index (RMI) report by the Regional Australia Institute and Commonwealth Bank reveals Bunbury experienced a 388.9% annual increase in net capital-to-regional migration over the 12 months to December 2024, retaining its status as the nation’s top hotspot for city dwellers relocating regionally. This growth outpaced traditional favourites like Bendigo, which saw a fourfold increase in migration but still trailed Bunbury’s near fivefold surge.

3 :: Bunbury’s appeal stems from major infrastructure projects, including the Wilman Wadandi Highway, completed in late 2024, which reduced travel times between Perth and the South West by 30%14. This connectivity has transformed Bunbury into a viable commuter hub for FIFO workers and hybrid professionals, with 42% of new residents citing proximity to Perth as a key factor in their relocation.

4. Housing Market Dynamics: Bunbury’s property market has mirrored its population boom, with the median house price rising 28.5% to $591,250 in 2024–25 – the highest growth rate among WA regional centres. REIWA data shows the $650,000–$800,000 price bracket dominates sales activity, driven by demand from:

-

Former Perth residents seeking affordability (Bunbury’s median house price is 37% lower than Perth’s $940,000)

-

Eastern States investors pivoting from saturated markets

-

Local upsizers capitalising on equity gains

The market remains supply-constrained, with listings absorbing 14 days faster than the WA regional average5. This pressure has extended to rentals, where vacancy rates hover at 0.8% despite a 12% increase in rental stock since 20245.

Product Demand Fortifies Accelerating Sales

Few sectors can match this industry’s impressive historical and obvious future growth prospects. In fact, several credible sources have reported this sector to expand in excess of $4 billion from 2024 to 2030, driven by a large percentage of the population centred on purchasing cost-saving sustainability products. Along with the continued growth of its current product range, new products are poised to accelerate sales at an even faster rate.

Exclusive Territorial Distribution Rights…

….Makes It Hard To Go Wrong

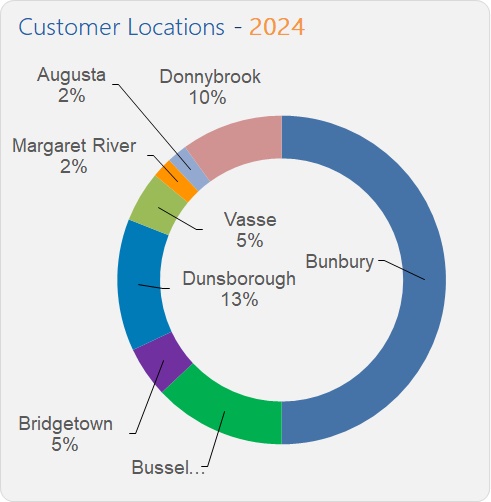

The exclusive territorial supplier agreement covers an extensive distribution zone covering a broad range of communities from Bunbury, Busselton, Margaret River, Augusta and many other towns to the lower southern borders of WA.

10,000 + Customers Can’t Be Wrong!

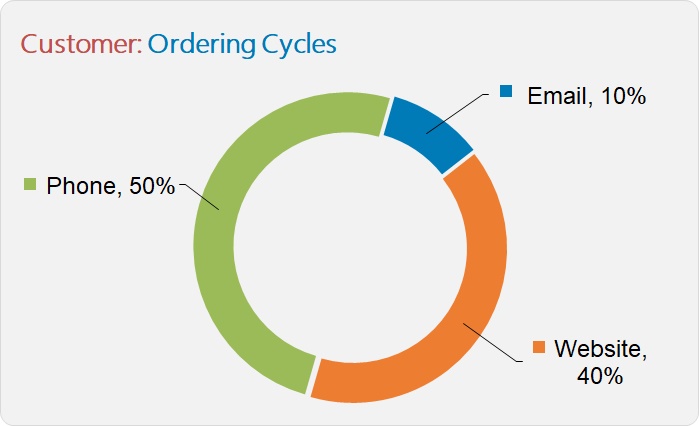

With a presence in the region going back over two decades, the business has cultivated a substantial client base of approximately 10,000 customers, with around half of annual sales generated from repeat orders.

With a presence in the region going back over two decades, the business has cultivated a substantial client base of approximately 10,000 customers, with around half of annual sales generated from repeat orders.

These repeat transactions are consistently driven by demand for spare parts, service, and product replacements, ensuring a steady and dependable revenue stream.

Additionally, as the exclusive wholesaler and distributor in the vast, high-growth southwest region, the business maintains a high level of customer retention, as its clients rely on it for ongoing parts and servicing.

As mentioned, the business benefits from a large, diverse client base, with no single customer accounting for more than two percent of annual sales. This balanced structure promotes revenue stability and mitigates dependency risks, protecting the company from fluctuations in demand from any individual customer. This is a key feature rarely found in other businesses.

Barriers To Market Entry…

It would be highly challenging for new competitors to put a dent in this business’s sales, as they lack access to the well-established, trusted brand that has been recognised in Australia and overseas for over five decades. This proven reliability instils the sense of security customers need to place orders. Additionally, in the Southwest, this business has spent over 20 years building a loyal customer base of approximately 10,000 clients, leaving any potential competitors at a significant disadvantage.

Simple To Operate – No Experience Necessary…

The current owner, despite having no prior industry experience before buying this business, easily learnt the business operations with the support of the principal manufacturer supplier. In addition, the current owner will provide 4 weeks of training free of charge from the settlement date.

The owner can take holidays…

With divisional managers and supervisors in place, the owners confidently rely on their loyal staff to manage the business during holidays or short breaks.

Upfront deposits & 7-day Debtors – Reduce Working Capital Requirements

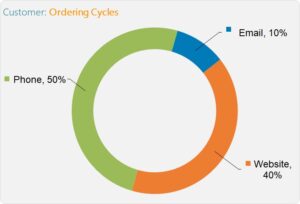

This business benefits from a strong cash flow, with around 70 percent of debtors making payments within just seven days. Any outstanding pre-payments will be transferred to the buyer on the settlement date, less any costs incurred by the current owners.

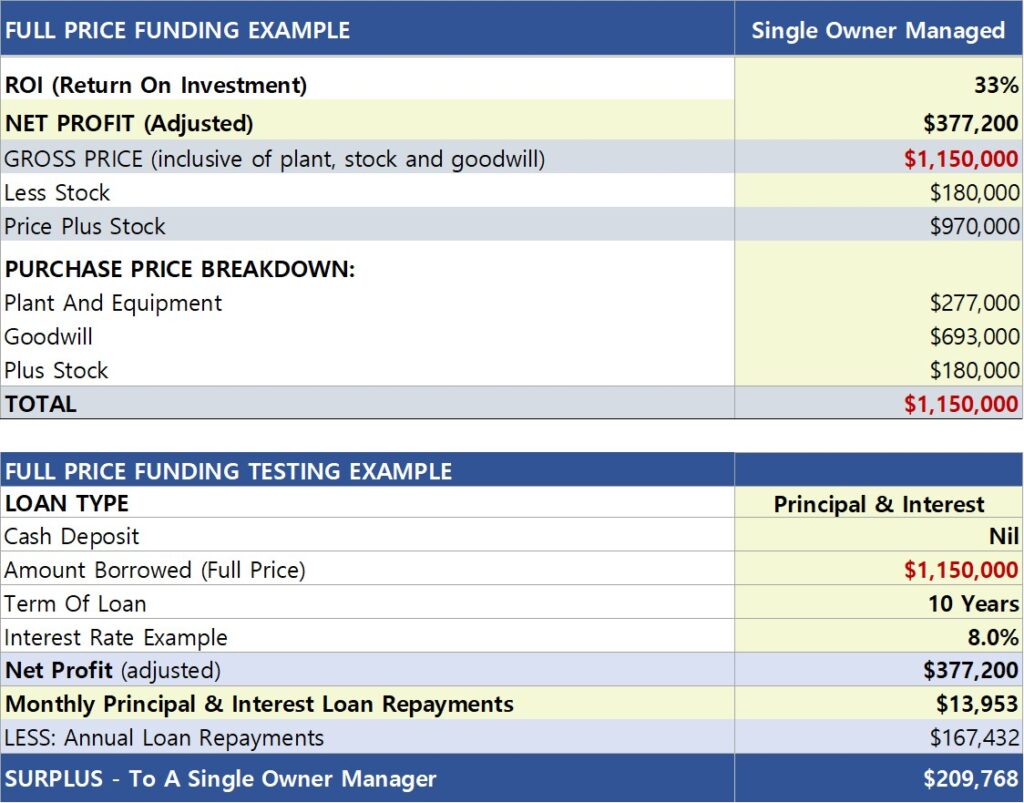

High asset mix in purchase price…

As previously mentioned, a significant portion of the purchase price consists of tangible stock ($180,000) and equipment ($150,000). This asset-rich structure not only lowers risk compared to businesses with low-valued physical assets but also has the potential to deliver higher bottom-line profits. By leveraging depreciation as a non-cash expenditure on its long-life equipment, the business has the potential to effectively minimise its tax liabilities through the write-off of plant and equipment.

The Ultimate – Self-Funding Business Investment

As If It Couldn’t Get Any Better!…

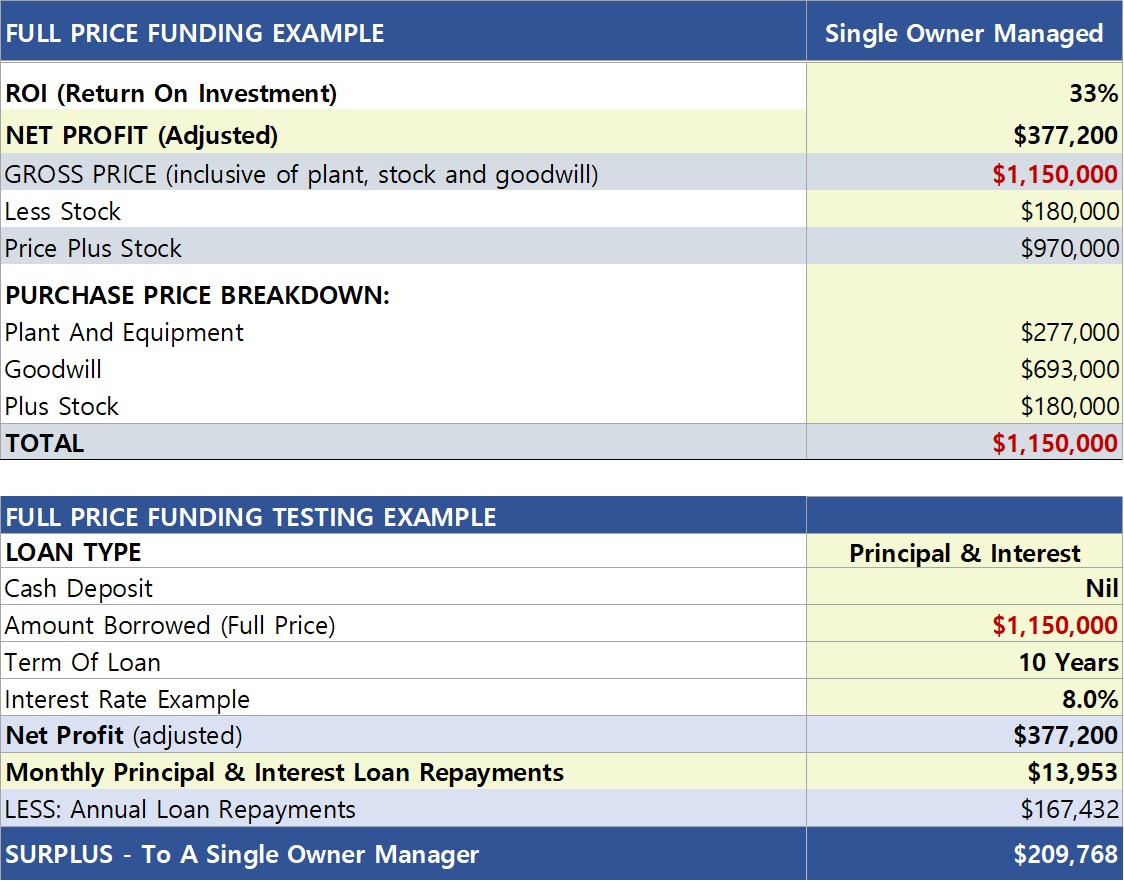

Imagine a business that offers a low-risk opportunity and a robust capacity to finance the total asking price, with the buyer providing bank-approved collateral security.

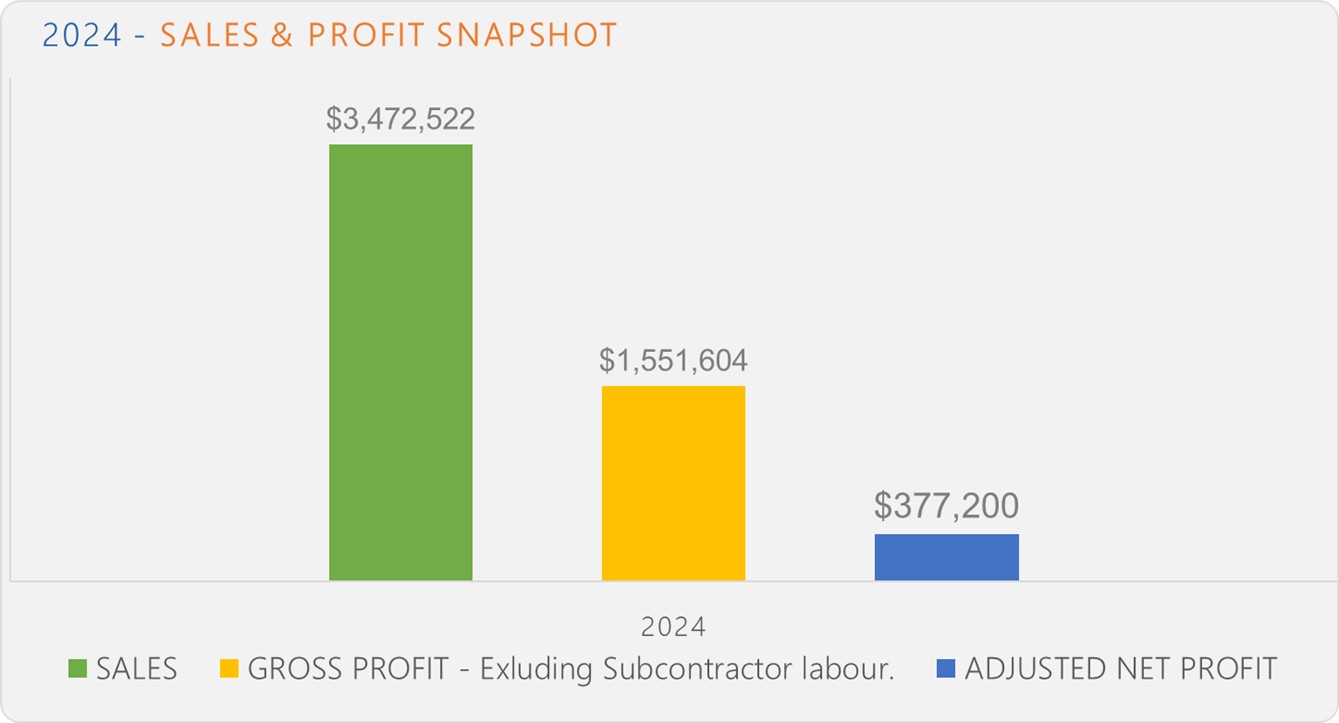

For example, considering a net profit of $377,200, a 10-year principal and interest loan pay-back term, an asking price of $1,250,000 and a future interest rate of 8%, the Business has the potential to generate a cash surplus of $209,768 per annum.

Yes! – that’s right, this surplus remains intact even after accounting for full-price principal and interest loan repayments.

Upon closer examination of this self-funded investment strategy, a compelling picture emerges. Not only has the Business consistently generated substantial annual cash surpluses from its net profit, but it has also effectively financed its own purchase by servicing the full-price loan repayments from its net profit. Remarkably, as the Business continues its trajectory of success, a valuable asset is steadily gaining momentum in the background, creating the potential for a higher selling price based on a multiple of three times profit in the future sale price of the business.

This has to be the ultimate self-funded, positively geared investment opportunity.

Note: it is important to note that the above example does not reflect individual owners’ requirements, such as working capital, personal taxation payments, owners’ drawings, movement in interest rates, etc., and other personal expenses that may change the expected cash surplus. Accordingly, there is no representation, warranty, or any other assurance that any of the variables, approvals, assumptions, or forecasts mentioned above will be realised. As a result, we strongly recommend that each buyer contacts their accountant, legal advisor, and lending institution to satisfy themselves with the expected cash surplus return and the opportunity to qualify for the necessary loan approvals.

The Conservative Advantage! – Unlocking Potential Sales Growth:

Having reached retirement age, the current owners have for some time adopted a conservative management approach, prioritising lifestyle over profit.

Our comprehensive 100+ page business acquisition profile highlights numerous exciting opportunities for growth. Among the most promising is the potential to establish additional sub-branches in rapidly expanding towns within the business’s exclusive and extensive territory. This growth aligns perfectly with increasing population trends, which drive demand for the business’s cost-saving products, offering a clear and straightforward path to boost profitability significantly.

Venture Securely: Low-Risk Path to Wealth!

Finding a Business that combines tremendous growth potential with stability to navigate through both good and bad times, providing its owners with peace of mind, is a rarity.

Finding a Business that combines tremendous growth potential with stability to navigate through both good and bad times, providing its owners with peace of mind, is a rarity.

Please note that the sale of this Business is highly confidential, and, therefore, the owner has explicitly requested that no phone information be shared until a confidentiality agreement has been signed.

Register your interest now by clicking on the “email me” link at the top right-hand corner of the screen, and I will let you know once the business report is finalised.

Key Features

- Genuine reason for sale - retirement

- High gross profit margin of 45%

- Exclusive essential product supplier status

- 10,000 + customers – built over decades

- Rapid payment of accounts – 70% pay in just 7-days

- No one client represents more than 2% of sales

- 20 + years established

Enquire Now

Enquire Now

contact broker

JUST SOLD

A snapshot of recent successful Business sales include:

-

SOLD Plasma Metal Cutting - Sold in 3 weeks - $4,250,000

SOLD Plasma Metal Cutting - Sold in 3 weeks - $4,250,000

-

SOLD Glass Film Wholesaler - Sold in 3 weeks - $2,130,000

SOLD Glass Film Wholesaler - Sold in 3 weeks - $2,130,000

-

SOLD Automotive S/W - Two full price offers presented in 3 Days - $720,000

SOLD Automotive S/W - Two full price offers presented in 3 Days - $720,000

-

SOLD Automotive Industries - Sold in 2 weeks with no advertising - $2,450,000

SOLD Automotive Industries - Sold in 2 weeks with no advertising - $2,450,000

-

SOLD Food Wholesaler - Sold in under a week - Full price offer - $2,950,000

SOLD Food Wholesaler - Sold in under a week - Full price offer - $2,950,000

-

SOLD Coffee Import Wholesaler: Sold in 3 weeks - full price offer - $2,350,000

SOLD Coffee Import Wholesaler: Sold in 3 weeks - full price offer - $2,350,000

Loan Calculator

| Principle & Interest | Interest Only | |

|---|---|---|

| $1234.00 pcm | $1234.00 pcm | |

| $1234.00 pa | $1234.00 pa | |

| $1234.00 | $1234.00 |